CIR and CII: Differences, accumulation and benefits for your digital projects

Table of contents

- What is the Research Tax Credit (CIR)?

- What is the Innovation Tax Credit (CII)?

- CIR vs CII: What are the key differences?

- Eligible expenses under the CIR and the CII

- How to combine CIR and CII to maximize your funding

- The advantage of CIR/CII approval with BeTomorrow for your projects

- Areas of expertise BeTomorrow

- Conditions and steps to obtain the CIR and the CII

- The tax ruling (rescrit fiscal): secure your position

- FAQ: Your questions about the CIR and the CII

- Take action: maximize your tax benefits

The Research Tax Credit (CIR) and the Innovation Tax Credit (CII) are two major tax incentives supporting the growth of technology-driven companies in France. Although complementary, they finance different stages: pure R&D for the CIR, and new product prototyping for the CII.

How can you clearly distinguish between them? Can they be combined? Which expenses are eligible? A complete breakdown of these schemes—and the strategic value of working with an approved agency like BeTomorrow.

BeTomorrow has been officially approved for CIR and CII by the French Ministry of Research since 2023. This approval enables our clients to recover up to 30% of the amount of their eligible digital projects.

What is the Research Tax Credit (CIR)?

Definition and objectives of the CIR

The Research Tax Credit is a tax incentive created in 1983 and gradually strengthened to encourage French companies to invest in research and development. Its principle is simple: you recover 30% of your R&D expenses as a tax credit, up to €100 million per year (above this threshold, the rate drops to 5%).

The CIR covers three types of activities recognized by the Frascati Manual (OECD international standard):

Fundamental research: Theoretical work with no immediate commercial application

Applied research: Projects aimed at a clearly defined practical objective

Experimental development: Systematic activities designed to overcome technological barriers or push the state of the art further

Warning: Simple software development is not sufficient. For a digital project to be eligible for the CIR, it must involve technical uncertainties requiring research work to go beyond the current state of the art.

Who can benefit from the CIR?

All companies subject to corporate income tax or personal income tax (BIC) can benefit from the CIR, regardless of size or sector:

Tech startups and scale-ups

Digital SMEs and mid-sized companies

Large industrial groups

Approved digital agencies (such as BeTomorrow)

This scheme is particularly strategic for software development, where projects frequently involve R&D phases (algorithm optimization, innovative architectures, advanced security).

What is the Innovation Tax Credit (CII)?

Definition and SME-specific features

The Innovation Tax Credit is the “little brother” of the CIR, created in 2013 to specifically target downstream innovation phases. It covers expenses related to the design of prototypes and pilot installations of new products.

Key features of the CII:

Reserved exclusively for SMEs under EU definition (fewer than 250 employees, turnover < €50M or balance sheet < €43M)

Reimbursement rate of 20% of eligible expenses

Annual cap of €400,000 in tax credit per company

Unlike the CIR, which requires a break with the state of the art, the CII finances market innovation: your product must demonstrate superior performance (technical, ergonomic, or functional) compared to competing products—without necessarily involving scientific research.

Concrete example: A mobile application offering a revolutionary user interface or a completely new UX experience may be eligible for the CII, even if it relies on standard technologies.

CIR vs CII: What are the key differences?

Understanding the boundary between these two schemes is essential to maximize your tax benefits.

The table below summarizes the key differences between the Research Tax Credit (CIR) and the Innovation Tax Credit (CII) in terms of eligibility, objectives and financial benefits.

Criteria | CIR | CII |

Objective | Finance pure R&D (overcome technological barriers) | Finance innovative product prototyping |

Nature of innovation | Technological innovation (scientific state of the art) | Market innovation (superior performance) |

Beneficiaries | All taxable companies in France | SMEs only (< 250 employees) |

Reimbursement rate | 30% (up to €100M), then 5% | 20% |

Annual cap | €100M (then reduced rate) | €400,000 |

Types of expenses | Research salaries, equipment, patents, R&D subcontracting | Prototype design, pilot installations, testing |

Tax form | 2069-A-SD | 2069-A-SD (dedicated section) |

The boundary can sometimes be blurry. A project may start with a CIR phase (development of a new algorithm) and then shift to a CII phase (creation of the commercial prototype). This is why a tax ruling (rescrit fiscal) is crucial to secure your position with the tax authorities.

The notion of state of the art is central to the CIR: your teams must demonstrate that no existing technical solution could solve the problem without research work. For the CII, it is sufficient to prove that your product outperforms competitors.

Eligible expenses under the CIR and the CII

Eligible expenses for the Research Tax Credit (CIR)

The scope is broad and covers the entire R&D value chain:

Personnel expenses

Salaries and social contributions of researchers and research technicians directly assigned to R&D projects

Compensation of engineers involved in experimental development

Young PhDs: doubled expense base for 24 months (strong incentive measure)

Operating expenses

Flat-rate calculation: 43% of personnel expenses for SMEs, 75% for other expenses

Or actual costs (consumables, energy, scientific documentation)

Depreciation expenses

New equipment and materials directly used for R&D (servers, specialized software licenses, development tools)

Subcontracting expenses

Approved subcontractors (such as BeTomorrow): expenses taken into account at 200% of the invoiced amount, capped at €12M

Subcontracting to public research bodies (universities, CNRS): also increased

Intellectual property costs

Patent filing and maintenance

Patent defense costs under certain conditions

Warning: Technology monitoring expenses, even if related to R&D, are not eligible for the CIR. Only activities generating new technical knowledge qualify.

Eligible expenses for the Innovation Tax Credit (CII)

The scope of the CII is narrower and focused on the prototyping phase:

Prototype design: Salaries of project teams (designers, developers, project managers) involved in prototype creation

Pilot installations: Costs related to setting up a test production line or a beta version of the product

Operating expenses: Flat-rate calculation (43% of salaries)

Design and model filings: IP protection costs related to the new product

Exclusions: Unlike the CIR, the CII does not cover corrective maintenance expenses or incremental improvements to an existing product.

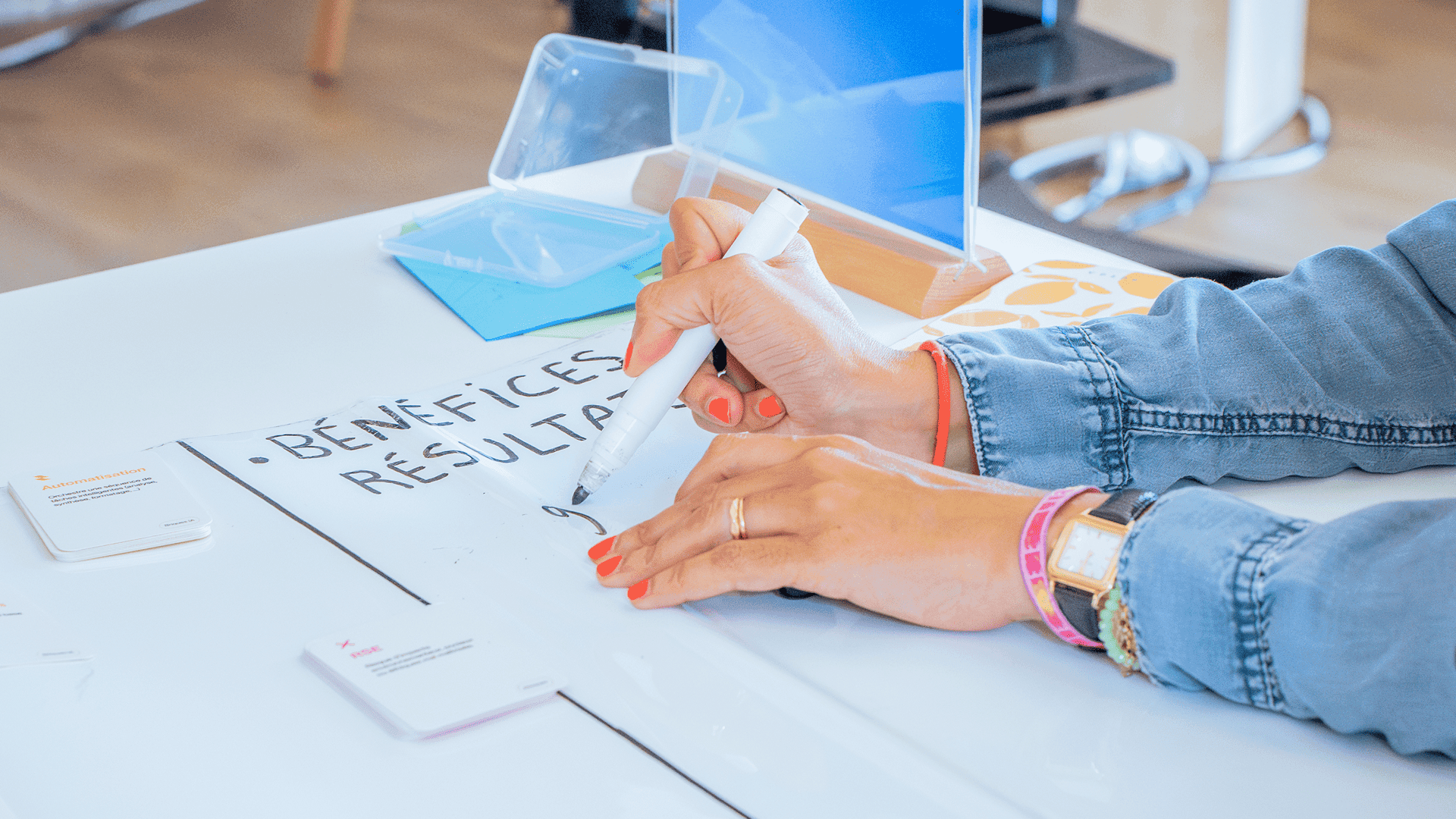

How to combine CIR and CII to maximize your funding

Yes, combination is allowed—and it is one of the major strengths of the French tax system for innovative companies. It allows you to cover the entire value chain, from fundamental research to market-ready prototypes.

Optimal combination strategy

Here is how to structure a digital project to maximize both schemes:

Phase 1 – Research & Development (CIR):

Design of an innovative technical architecture

Development of proprietary algorithms

Resolution of technological barriers (performance, scalability, security)

Technical feasibility testing

Phase 2 – Prototyping & Innovation (CII):

MVP (Minimum Viable Product) design

Development of an innovative user interface

User testing and prototype iterations

Validation of the market value proposition

Concrete example: An SME develops a predictive SaaS platform. It invests €200,000 in R&D (proprietary AI development) eligible for the CIR → €60,000 recovered. It then invests €100,000 in commercial prototyping (innovative UX/UI) eligible for the CII → €20,000 recovered. Total recovered: €80,000, i.e. 28% of the total budget.

💡 : Carefully document the distinction between CIR and CII phases in your timesheets and technical reports. The BOFiP (Official Tax Bulletin) is strict about separating expenses.

Conditions for combining CIR and CII

The combination is subject to compliance with the EU de minimis regulation for the CII only. Make sure that the total de minimis aid received over three years does not exceed €300,000.

The advantage of CIR/CII approval with BeTomorrow for your projects

Why choose an approved CIR/CII agency?

Working with BeTomorrow, officially approved by the French Ministry of Higher Education and Research, offers three decisive advantages:

1. Doubling of the eligible expense base

When you subcontract your R&D projects to an approved organization, your expenses are taken into account at 200% of the invoiced amount (capped at €12M per year).

Concrete calculation: You pay €100,000 (excl. VAT) to BeTomorrow for an eligible development project. You declare €200,000 in CIR expenses. At a 30% rate, you recover €60,000 instead of €30,000.

2. Technical expertise and robust documentation

Our teams master the CIR eligibility criteria applied to digital projects:

Identification of technological barriers

Formalization of R&D work: technical deliverables, progress reports, documentation of failures and pivots (essential for tax authorities)

Technology monitoring: our digital experts stay at the cutting edge of the state of the art

3. Securing your tax file

BeTomorrow ensures full traceability of services—crucial in the event of a tax audit:

Detailed project tracking sheets

Technical reports compliant with BOFiP requirements

Support for building your CIR/CII file with your accounting firm

Warning: BeTomorrow does not determine the final eligibility of your project for the CIR/CII (to avoid conflicts of interest). We recommend validating your file with a specialized firm such as Jubea, fi-initiatives, or EIF Innovation.

Areas of expertise BeTomorrow

Our areas of expertise cover cutting-edge technologies particularly well-suited to the CIR:

Cloud-native architectures: scalability, high availability, data

Innovative mobile applications: AI, 3D, XR

Conditions and steps to obtain the CIR and the CII

Eligibility criteria

For the CIR:

Be subject to corporate or personal income tax (BIC)

Conduct fundamental, applied, or experimental R&D activities

Be able to justify the scientific nature of the work (state of the art, technical uncertainties)

For the CII:

Meet the EU definition of an SME

Design prototypes of new products or pilot installations

Demonstrate superior performance compared to competitors

Declaration process (2026)

Step 1: Identify and document projects

Prepare a technical file for each project including:

Description of scientific and technical objectives

Initial state-of-the-art analysis (bibliography, patents, existing solutions)

R&D methodology

Results obtained (including failures, proof of experimental nature)

Human and material resources involved

Step 2: Calculate eligible expenses

Use analytical accounting to isolate:

Employee hours allocated to the project (mandatory timesheets)

Subcontracting invoices from approved providers

Depreciation of dedicated equipment

Step 3: Tax declaration via form 2069-A-SD

The Cerfa form 2069-A-SD must be filed with your annual tax return:

Section I: Personnel expenses

Section II: Operating expenses

Section III: Subcontracting expenses (distinguishing approved providers)

Section IV: Patent-related expenses

CII section: completed separately for SMEs

The tax credit is offset against corporate tax due. If it exceeds the tax owed, the balance is refundable (immediately for SMEs and young innovative companies, after 3 years for others).

The tax ruling (rescrit fiscal): secure your position

The CIR tax ruling allows you to consult the tax authorities before incurring expenses. You present your project and request confirmation of its eligibility.

Benefits of the tax ruling:

Full legal certainty

Prevention of tax reassessments

Clarification of grey areas (especially experimental development qualification)

The ruling must summarize your project and be sent to the regional research and technology delegation. Expected response time: 3 months.

FAQ: Your questions about the CIR and the CII

Is the development of a standard mobile application eligible for the CIR?

No, not as such. Standard application development using common frameworks (React Native, Flutter) is not eligible. However, if your project includes R&D phases (algorithm optimization, data architecture for real-time large-scale processing), these specific phases may qualify.

Can I declare failed projects under the CIR?

Yes, absolutely. Failure is an integral part of R&D. A project that does not result in a commercial outcome but generates new technical knowledge is fully eligible, provided it is properly documented.

What is the difference between approved and non-approved subcontracting for the CIR?

Approved subcontracting (CIR-approved provider like BeTomorrow): 200% of invoiced amount, capped at €12M

Non-approved subcontracting (freelancers, standard agencies): 100% of actual costs, capped at €2M

Can the CIR be combined with other public aid?

Yes, with most public aid (Bpifrance grants, regional subsidies). However, subsidies must be deducted from the CIR calculation base to avoid double funding.

How long can I carry forward unused CIR credits?

Unused CIR credits generate a refundable claim:

Immediately for SMEs, JEIs, and new companies

After 3 years for other companies

Do I need to declare the CIR if my company is in a tax loss position?

Yes. The CIR is a tax credit, not a tax reduction. You are entitled to it even if you do not pay corporate tax, in which case the State refunds the amount.

Take action: maximize your tax benefits

The CIR and the CII are not just tax loopholes. They are powerful strategic levers to finance up to 30% of your digital innovation projects. By combining them intelligently, you turn R&D costs into partially reimbursed investments.

BeTomorrow supports you end to end:

Technical framing of projects to identify eligible R&D phases

Project execution by expert teams

Full documentation compliant with tax requirements

Support for building your file with your tax advisor

Do you have an innovative project underway or under consideration? Contact our team to assess its eligibility for the CIR and CII schemes. Our technical experts will get back to you within 48 hours.

Discover our resources: Find all our insights on digital innovation on our blog, including our latest articles on generative AI, MCP servers, and AI adoption by French companies.

Official sources:

BOFiP – BOI-BIC-RICI-10 (CIR tax doctrine)

Frascati Manual 2015 – OECD