Bank - Insurance

Transform bank and insurance sectors by harnessing the power of digital.

Digital transformation - Generative AI - Data Science - Change management - API - UX/UI strategies

"In a market where 70% of digital transformations fail, banks and insurance companies must excel. Adopting new technologies is no longer enough: we need to reimagine business models, anticipate customer behavior, and build sustainable, secure solutions."

Our autonomous, multidisciplinary teams combine in-depth technical expertise with a clear strategic vision, enabling us to deliver projects on time and on budget. We develop tailor-made, customer-focused solutions, adopting best practices and the most effective technologies.

Our clients

HERVÉ MANCERON

Co-founder and COO of Skaleet (ex-TagPay)

The result is very good: in just 4 months, we have a very nice application. I am proud of the app! The foundations are good and we have a good functioning of the app with the API, the bar is high. But we shouldn't stop there !

Our projects

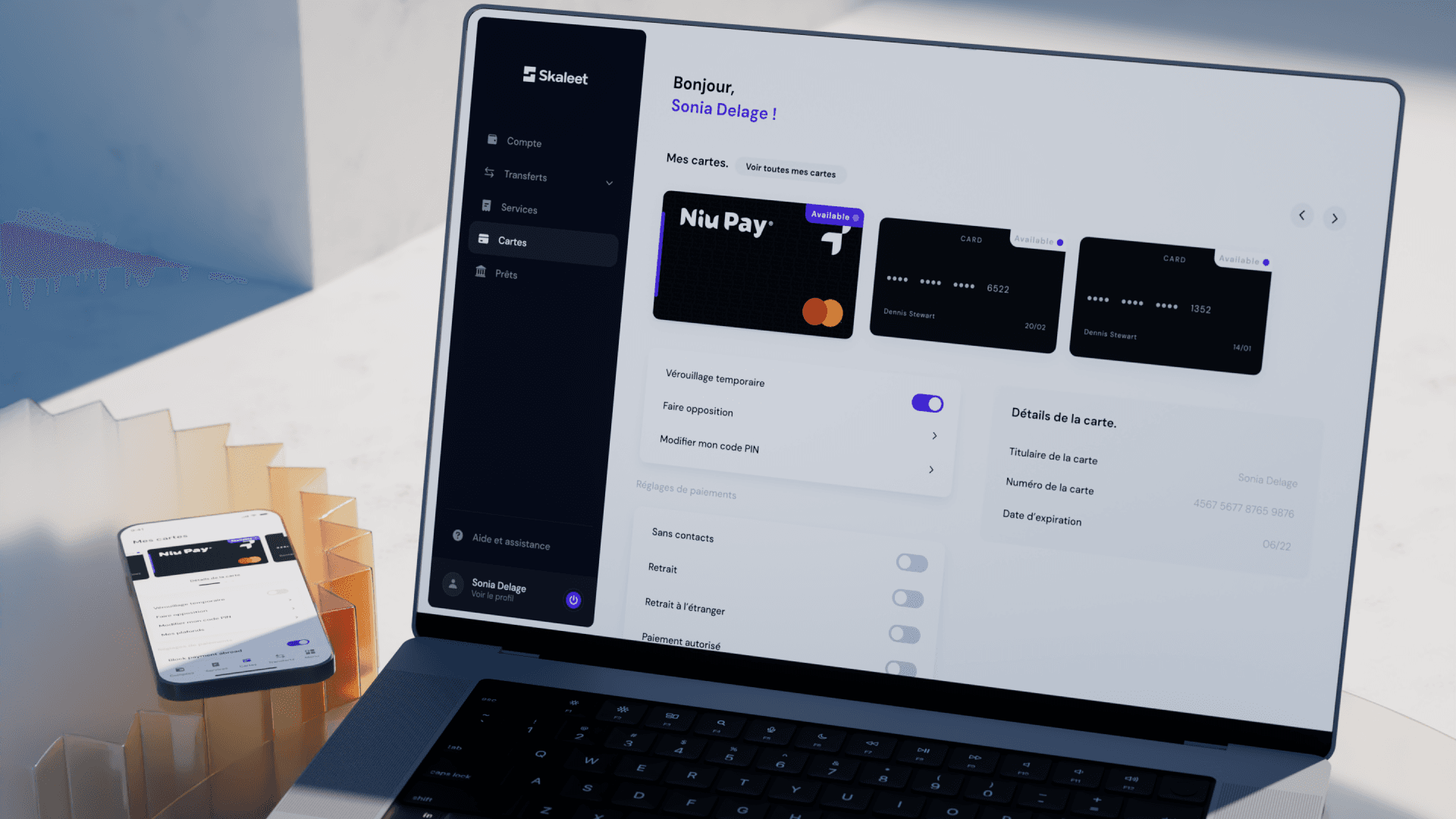

Skaleet

Strengthen the mobile offer via a secure application, allowing end customers to manage their finances, in a wide variety of contexts. Skaleet called on BeTomorrow to create a mobile application with customizable design, adapting to customer needs and market specificities.

Goal

BeTomorrow supported Skaleet to completely redevelop his application, for emerging countries, but also to seduce Western countries. This involved an iOS and Android design to suit a wide variety of devices and performance levels. So, the team has produced a state-of-the-art design, a “Frugal design ” that should allow it to be user-friendly, inexpensive and both very successful. Skaleet also relied on product strategy and product analytics advice from BeTomorrow to optimize the market fit. Finally, the application thus developed fits into a context of strong authentication DSP2 (Directive on Payment Services).

Skaleet has just raised 25 million euros in funds to deploy its core banking system.

Results

👉 Context of a payment application in emerging countries

👉 Functional breakdown and follow-up of the roadmap with respect for budgets and deadlines

👉 Designs at the level of best references on the market with diversity of devices.

👉 Regular user tests

👉 Application security in the DSP2 context

The BeTomorrow expertise

BeTomorrow meets banks and insurance companies needs as a trusted and strategic technology partner. We embrace an Open Innovation approach to anticipate these sectors challenges. Our experts optimize your services, simplifying and making them more inclusive. We support the innovation, industrialization, and customization of your products while enhancing your teams skills.

Ready to start ?

Guarantee high-performance applications and systems with a "by design" API approach.

Generative and conversational AI design and deployment.

Agile coaching and change management implementation.

Data science approaches execution.

Data security enhancement.

Product design, brand identity and user-centered UX/UI strategy.

Our offers

Optimize your data value with our Data Science expertise

We centralize and secure your data with a robust, scalable infrastructure. We use a data-driven approach to better understand customer usage and personalize your services, thereby increasing customer satisfaction and loyalty. Our advanced technologies analyze key data such as credit score and income, enabling the creation of specific products such as flexible loans and adjustable insurance, optimizing your customers' budgets and savings.

Generative AI: a revolution for banks and insurance companies

Automate your time-consuming and tedious tasks with generative AI and free up time to financially advise your customers. We help you harness the power of generative AI to meet consumers' financial challenges via RAG and open source LLMs: setting up ultra-efficient underwriting tunnels, automated loss/theft/disaster management, user screening to personalize your offers... The possibilities are endless!

Enhanced security standards and sovereign Cloud hosting

Our teams work with financial and insurance experts to secure their data and transactions. This expertise guarantees products tailored to emerging markets, promoting financial inclusion and ease of use. Our infrastructures are hosted on secure clouds, built according to SECNUMCLOUD principles, such as S3NS or Outscale.

Training workshops, executive coaching and agile transformation

By your side, we rethink the structure, operation and practices of your organization. Evolving security standards and Open Banking make agility essential for banks and insurance companies. BeTomorrow can help you adopt agility on a large scale to achieve your financial goals, reduce time-to-market and improve collaboration. We also offer tailor-made workshops to optimize the skills development of your teams.